The space sector is going through a deep transformation in the various segments of its value chain. As a result of these changes, it is reinventing its business models and speeding up its technological development, prompting the traditional players to review their strategies.

Pricewaterhouse Coopers (PwC) provides industry-focused services for public and private clients. As Manager of PwC’s Space Practice based in Paris, William Ricard has been working more than 7 years in advisory related to the space industry and the exploitation of satellite-based data. He has been advising public and private space organisations in strategic assignments ranging from socio-economic impact assessment of new policy and programmes related to space activities, to innovative digital business models and go-to-market strategies development. We spoke to him at DataSpace in Glasgow to gain his perspectives on this “newspace” revolution.

What brings you to DataSpace?

PwC has a space practice based in Paris and operating at global level. We provide advisory services related to strategy and policy development and implementation for institutional and commercial space actors. We have notably developed over the last years a strong understanding of the geospatial market. In this new context of NewSpace and democratisation of the use of satellite imagery, PwC has a new solution to help our customer leveraging on the new advancements related to imagery processing, cloud computing and data fusion to build geospatial capacity. We also use the same solution internally to solve problems our consultants are facing in their assignments. Indeed, we rely a lot on statistics and very often such data are not available or reliable, so we use EO imagery and deep learning to extract data and information to solve client problems. From our client and our consultant, the aim is to provide them with Insights from Space to solve their problems.

How do you define and quantify “space” in your reports?

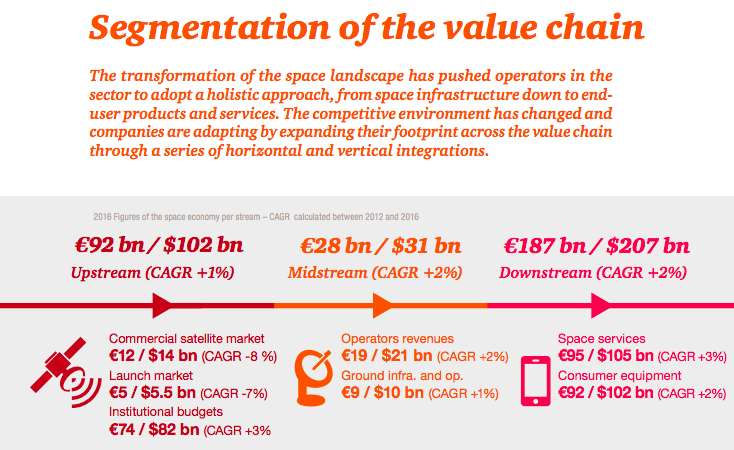

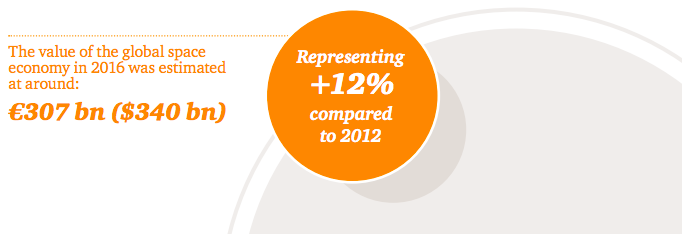

That is a one million dollar question. The notion of space is really hard to define and more and more it is blurring when it comes to satellite-based data exploitation. We used to have this traditional value chain, which was quite classical with upstream (i.e. satellite manufacturing & launcher), midstream (i.e. satellite operation & ground segment) and downstream (i.e. collection, dissemination & exploitation of data). So we were considering everything above the skyline to be a part of space. But more and more, we see collaborations and interconnection between space and non-space actors, making the definition of “space activity” even more complex. When considering advancements in cloud computing, artificial intelligence, data fusion, etc., this trend is not expected to diminish in the future. Space is everywhere: we talk about space in agriculture, space in oceans and environmental monitoring. It is now something global.

So we don’t define “space” per se but we are working more on specific areas like earth observation, satellite navigation or launchers. We are not talking about “space” but about integrated applications, including end user benefits. This is specifically key when we performed socio-economic impacts assessment related to a specific investment or policy supporting space activities, where we need to understand all the stakeholder affected (positively and negatively) whether they are inside or outside the space community.

Who are your typical clients?

We have worked a lot with the European Commission to support them on the European Union Space Strategy and the European Space Agency (ESA). We also work with specific countries to help them develop their national space programmes and space strategy. Finally, we also work extensively with private customers to help them in their business modelling, diversification and go-to-market strategies.

We are seeing such a change in the space industry from government and shift towards the private sector. What do you see as the future role of government?

Now it is changing, for sure with disrupting NewSpace companies, which are driven by private money. When you look really in detail at all these business models very often there is seed money from private investors such as venture capitalists and business angels. But governments still play a key role to support companies in the demonstration phase for R&D. In Europe, a lot of these initiatives are backed by public funding such EU Horizon 2020, ESA funding (e.g. EOEP, InCubed, ARTES, etc.) or national funding, giving a lot of confidence to private investors. The fact to have grants or contracts from governments have a positive impact on the decision to invest in a space start-up. I think government still plays a very important role in this. Also, I think it’s fundamental we have the right policy and ecosystem supporting these initiatives in Europe in order to develop and leverage on these new trends.

PwC is a very global company. Can you give us a bit of an insight to your work on the global vs. regional scale?

We are based in France but we have customers all around the world. We work mostly with customers in Europe but also North Africa, Middle East and also now pushing a lot with countries in Asia and Australia. We help building space expertise to our local offices for them to respond to local needs related to space activities. These help us to access very specific understanding of the local market, that we can use for benchmark exercise and new market entry strategies.

Which country would you see has the most growth potential and in which space domain?

As I am mostly focusing on Earth Observation and geospatial market, I am biased when it comes to pick the most growth potential! What is happening right now in the field of Earth Observation is a real revolution, where the specialised and niche Earth Observation market meets the huge and fast growing big data analytics market. We currently see a democratisation of the use of EO, thanks to the work performed by the EC and ESA to support Copernicus data dissemination and user uptake, thanks to all the new developments related to NewSpace in EO (e.g. small satellites constellations, etc.) but especially thanks to advancements in cloud computing that makes this big data easier to use and cheaper to use, plus easier to demonstrate without investing much money. To me this is an area that is hugely developing right now.

In terms of country of interest for the future, it’s really hard to pick one. I am very interested by China because we don’t know so much what is going on, as all study in space mostly focuses on Western Countries. At PwC we are currently pushing to work more with China as there is a lot of interest from them on how to export technologies and solutions on new markets (e.g. Africa). China may indeed play a major role in space activities in the future.

What would be your top predictions for what people should keep an eye on this year?

Again biased by EO… What I am interested in is all these developments towards constellations, accessing low revisiting time all around the globe, and video from space, improving the monitoring of moving objects. From an advisory standpoint it is a game-changer for moving object detection and statistics collection, in remote & isolated areas where access to reliable data is hard/impossible. I am looking forward to it!

What are your thoughts on the big super-giants of Facebook, Google and Amazon influencing space-data?

I think what we see today is very interesting. We have first seen Google acquiring Skybox for US$ 500M, renaming it Terra Bella. After 3 years, they have divested it to Planet for an undisclosed amount; we can imagine Google considers that providing satellite data is not part of their core activities, even if they are large EO volume user (e.g. Google Earth Engine). Then, you have Amazon Web Services (AWS) offering large volume of EO data (e.g. Landsat 8, Sentinel 2, soon Sentinel 1, etc.) on their Simple Storage Service (S3).

In both cases (Google & AWS), they offer a digital environment with EO data, many additional of source of non-EO data, strong computing power and low cost for storage: this offers very interesting solutions for data exploitation. I think there will still be room for a lot of companies in the market. They are more, in my opinion, business enablers more than harming the European industry. They allow the birth of many start-ups focusing in data exploitation, data fusion and data analytics. I think the growing interest by super-giants will help EO data dissemination & user uptake, indirectly very positively impacting on the European industry, especially for startups.